We define student engagement as being when students make a significant, psychological investment in their learning. In earlier blog posts, we discussed

how important it is for students to have support outside of school, as well as

the impact of engagement on post-graduation employment.

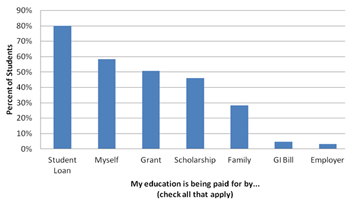

Another focus of our research revolves around student loan repayment. Indeed, as the costs associated with attaining higher education are rapidly increasing (e.g., tuition, books, living expenses), more students are relying on federal and private loans as a means to pay for their education. As the graph below depicts, the vast majority of students in our study (80%) are using loans to help pay for their education. Also noteworthy is that many of these students are paying for their education independently, as only 28% receive financial support from their families.

In addition, our research suggests that

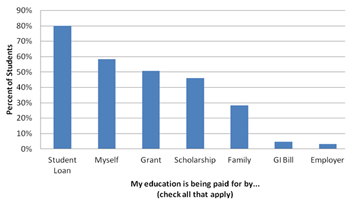

helping your students understand their loan commitments is perhaps the first step towards ensuring that your students successfully repay their loans. For example, the graph below depicts that students who agree that their educational costs were clearly explained are more likely to be up to date with their payments for education (81% vs. 66%).

Indeed, our research suggests that, with the right techniques, schools can reduce student loan defaults. By clearly explaining the costs of education, tuition payments, and student loan commitments, and providing useful information about financial aid options, students will be more likely to follow through on their loan commitments.

However, despite providing this information, sometimes it can be difficult for students to understand it, and then recall repayment expectations when their loans come due. Hence, one recommendation is to create a FAQ document about student loans. This could be a powerful way to clear up any misconceptions that students have regarding their loan obligations. Along similar lines, another recommendation is to take advantage of every opportunity to communicate with your students. It is important not only to arm students with information about their loans at enrollment, but also at graduation.

Lastly, by using a student engagement survey across time, schools can determine the effectiveness of their communications and use the data to modify those communications accordingly.

Have you found any techniques that help keep your students on track with their loan repayment?

In addition, our research suggests that helping your students understand their loan commitments is perhaps the first step towards ensuring that your students successfully repay their loans. For example, the graph below depicts that students who agree that their educational costs were clearly explained are more likely to be up to date with their payments for education (81% vs. 66%).

In addition, our research suggests that helping your students understand their loan commitments is perhaps the first step towards ensuring that your students successfully repay their loans. For example, the graph below depicts that students who agree that their educational costs were clearly explained are more likely to be up to date with their payments for education (81% vs. 66%).

Indeed, our research suggests that, with the right techniques, schools can reduce student loan defaults. By clearly explaining the costs of education, tuition payments, and student loan commitments, and providing useful information about financial aid options, students will be more likely to follow through on their loan commitments.

However, despite providing this information, sometimes it can be difficult for students to understand it, and then recall repayment expectations when their loans come due. Hence, one recommendation is to create a FAQ document about student loans. This could be a powerful way to clear up any misconceptions that students have regarding their loan obligations. Along similar lines, another recommendation is to take advantage of every opportunity to communicate with your students. It is important not only to arm students with information about their loans at enrollment, but also at graduation.

Lastly, by using a student engagement survey across time, schools can determine the effectiveness of their communications and use the data to modify those communications accordingly.

Have you found any techniques that help keep your students on track with their loan repayment?

Indeed, our research suggests that, with the right techniques, schools can reduce student loan defaults. By clearly explaining the costs of education, tuition payments, and student loan commitments, and providing useful information about financial aid options, students will be more likely to follow through on their loan commitments.

However, despite providing this information, sometimes it can be difficult for students to understand it, and then recall repayment expectations when their loans come due. Hence, one recommendation is to create a FAQ document about student loans. This could be a powerful way to clear up any misconceptions that students have regarding their loan obligations. Along similar lines, another recommendation is to take advantage of every opportunity to communicate with your students. It is important not only to arm students with information about their loans at enrollment, but also at graduation.

Lastly, by using a student engagement survey across time, schools can determine the effectiveness of their communications and use the data to modify those communications accordingly.

Have you found any techniques that help keep your students on track with their loan repayment?